No man (or woman) is an island as the saying goes. And it’s rare to find someone running a business who relies solely on their own skillset, judgement and expertise.

Most people are open to ideas and advice – whether that comes from friends, family, business associates or paid consultants. And while that advice can lead to positive outcomes, it can also be disastrous.

With that in mind, we surveyed more than 500 small and microbusiness owners to ask what the best and worst kind of business advice they ever received was, and what its impact was. Here’s what we discovered…

Good business advice

Alongside bad business advice goes good business advice. So let’s start with the good news. Of the business owners we surveyed, 95% said they’d received good business advice in the past. This was spread across a range of topics, including:

- admin and bookkeeping

- making the most of taxable expenses

- whether to focus on profit vs revenue

- investing in training

- growth and expansion

- productivity

- maintaining a good work/life balance.

Although only marginally, female business owners were more likely to have received good business advice (95.6%), compared to their male counterparts (94%).

The most common positive impacts of good business advice cited were:

- ranging levels of financial gain to the business (67.5%)

- being able to grow the business (27%)

- working more efficiently (22.8%)

- gaining new clients or work (19.1%)

- achieving a better work/life balance (17.3%).

Some business owners said they were also better able to retain existing clients or work (15.2%), and 8.2% were able to become more tax efficient.

Across those that reported some level of financial gain for the business, the average uptick equalled £12,481.70, with almost 1 in 10 gaining more than £25,000.

Industry and city breakdowns for good business advice

A breakdown of the data revealed the Industries most likely to have received good business advice as:

- accountancy

- banking and finance

- charity and voluntary work

- marketing, advertising, and PR

- public services and administration

- recruitment and HR

- sales

- science and pharmaceuticals

- teacher training and education.

Industries least likely to have received good business advice include:

- social care

- media and internet

- law

- leisure

- sport, and tourism

- environment and agriculture.

Business owners based in Birmingham, Bristol, Edinburgh, Glasgow, and Norwich were most likely to have received good business advice in the past. At the other end of the scale, the locations least likely to have received good business advice included Cardiff, Liverpool, and Newcastle.

Bad business advice

Now for the other side of the story. Of the business owners surveyed, 62% reported receiving bad business advice in the past. The bad advice covered a range of topics, including:

- finances and investments

- admin and bookkeeping

- contracts

- tax

- hiring personnel.

Interestingly, male business owners were more likely to have received bad business advice (67%), compared to their female counterparts (55.3%).

The most commonly cited negative impacts of bad business advice included:

- ranging levels of financial loss to the business (42.7%)

- personal stress (29.1%)

- losing existing clients (7.7%).

From a business perspective, some had an insurance claim made against them by a customer or client (6.8%), and some had to halt either recruitment (5%) or expansion plans (3.9%).

From a personal standpoint, 5% saw a loss of personal possessions, and 2.1% even lost their homes.

Across those that cited some level of financial loss for the business, the research reveals that bad business advice cost an average of £9,225.00, with 1 in 20 losing more than £25,000.

Accounting for 95% of all businesses, there were 5.3 million microbusinesses (0-9 employees) in the UK in 2021. Using our finding that 62% had received bad business advice in the past, this equates to a potential 3 million (3,286,000) microbusinesses. Assuming, based on our research, that 42.7% saw a negative financial impact, bad business advice has cost the UK’s microbusinesses an estimated £12.9bn (£12,943,800,450).

Industry and city breakdowns for bad business advice

Industries most likely to have received bad business advice include:

- media and internet

- social care

- healthcare

- accountancy, banking, and finance.

Industries least likely to have received bad business advice include:

- charity and voluntary work

- marketing, advertising and PR

- creative arts and design

- energy and utilities

- transport and logistics.

When it came to which industries were most likely to see financial losses as a direct negative impact of receiving bad business advice, those most affected were:

However, transport and logistics saw the biggest financial impact from bad business advice in actual figures, with an average loss of £16,450.35.

The top five based on actual financial losses also included energy and utilities (£16,214.79), information technology (£14,715.65), hospitality and events management (£12,675.25) and social care (£11.750.50).

Teacher training and education (£11,541.04), engineering and manufacturing (£10,856.29), and healthcare (£10,535.50) also saw bigger financial impacts than the average UK business (£9,225.00).

Further down the order, in the middle of the pack, sit business consulting and management (£9,148.97); creative arts and design (£8,805.15); property and construction (£8,250.96); charity and voluntary work (£8,000.50); public services and administration (£7,600.50); environment and agriculture (£7,333.83); retail (£6,802.97); media and internet (£6,500.50); leisure, sport, and tourism (£6,000.50); recruitment and HR (£6,000.50); and accountancy, banking and finance (£5,745.62).

The industries with the smallest financial impacts included science and pharmaceuticals (£3,500.50); law (£4,333.83); marketing, advertising, and PR (£4,335.50); sales (£4,750.50); and law enforcement (£5,667.17).

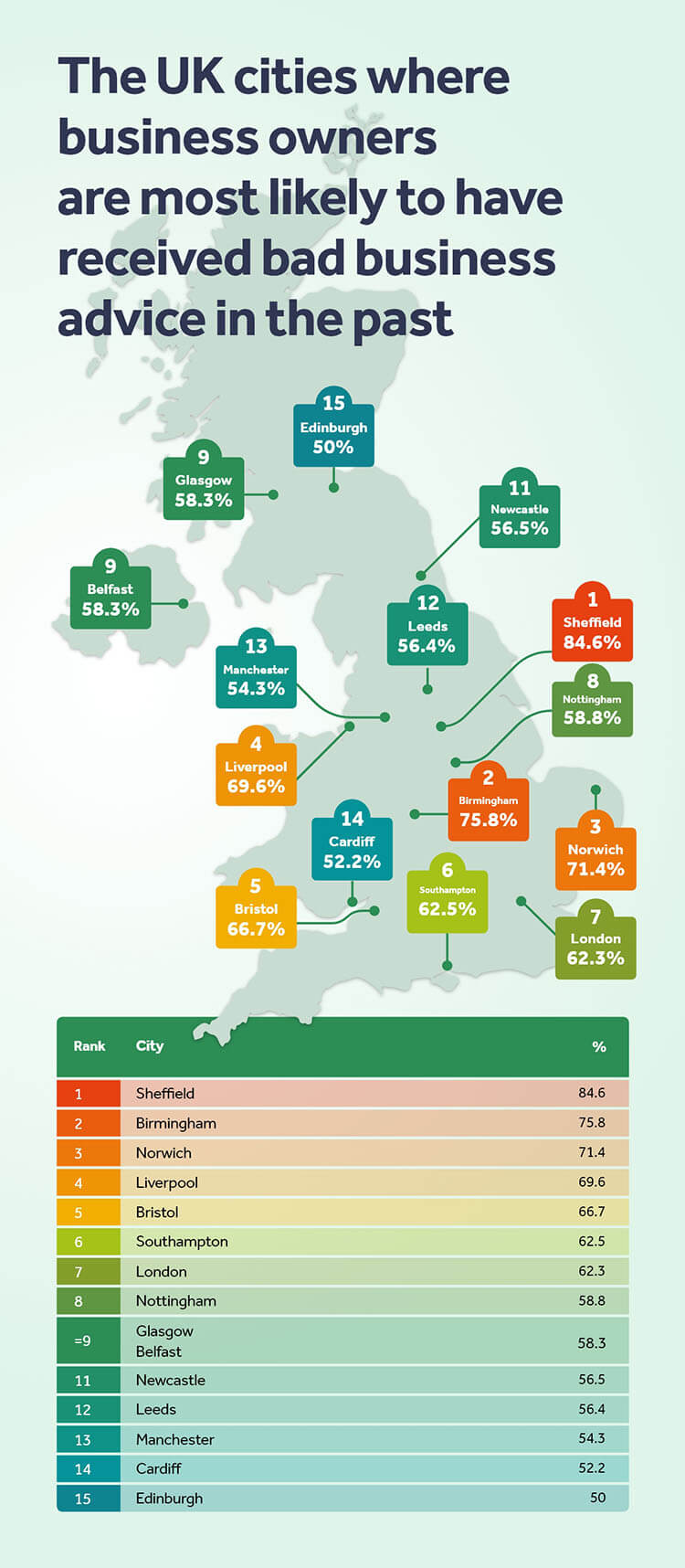

Looking at city-level locations, business owners based in Sheffield were most likely to have received some form of bad business advice in the past (84.6%), followed by Birmingham (75.8%) and Norwich (71.4%).

Next in the ranking came Liverpool (69.6%); Bristol (66.7%); Southampton (62.5%); London (62.3%); Nottingham (58.8%); Glasgow (58.3%); Belfast (58.3%); Newcastle (56.5%); and Leeds (56.4%).

The locations least likely to receive bad business advice included Edinburgh (50%), Cardiff (52.2%), and Manchester (54.3%).

Risky business

Bad advice can make businesses more vulnerable. It can increase the risk of mistakes being made, things going pear-shaped, and a claim of negligence, wrongdoing or worse landing on your doormat.

Dealing with legal claims takes time, money and expertise. That’s why it’s worth protecting your work, reputation, and bank balance with professional indemnity insurance.

It pays for a legal expert to fight your corner and picks up the tab for any compensation or damages you have to pay. That means it offers not only solid business protection but valuable peace of mind.

Find out more about professional indemnity insurance or call the team on 0345 222 5391.

- Survey conducted by The Leadership Factor (TLF Research) in April 2022, with a respondent pool of 543 business owners.

- Images used under license from Shutterstock.