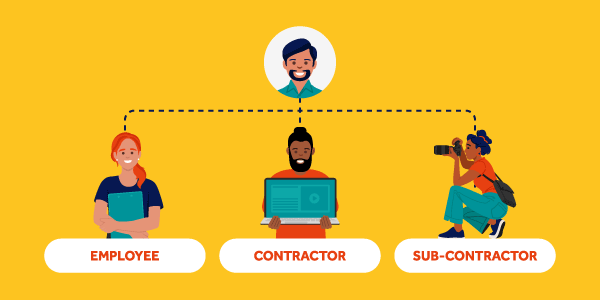

We all need a little extra help from time to time. Often, that’s someone whose expertise you can rely on to get the job done.

But if you’re taking on someone whose welfare you’re also legally responsible for, you’ll need to make sure you’re protecting them with the right insurance.

Which begs the question: do you need employers’ liability (EL) insurance for working with contractors? Or sub-contractors for that matter?

It’s important to do your research before you take any helpers on board. You can be fined heavily for not having EL: £2,500 for every day you’re supposed to have it but don’t.

Plus another £1,000 for not displaying a valid insurance certificate. Gulp.

Help, not hindrance

Employers’ liability insurance is a legal requirement if you have employees. That's because you have a legal and moral obligation to protect your staff’s health and safety while they're at work.

Carrying EL means if one of your employees has an accident or gets sick, their medical bills and any compensation they'd be entitled to are covered. As well as all the legal costs that comes with dealing with their claim.

But where does that leave you if you work with contractors or sub-contractors? Surely, being self-employed means they’re not your employees? And you don’t have to carry EL for them?

A wide definition

Well, there’s more to it than that. Because according to the Health and Safety Executive (HSE), you'd need employers' liability insurance for anyone ‘who you employ under a contract of service or apprenticeship’.

That includes any employed staff who are on your payroll and whose national insurance and income tax you handle. But also:

- Temps and seasonal staff

- Secondees

- Volunteers

- Work experience students

- Contractors and some types of sub-contractors.

So I do need employers’ liability insurance for contractors then?

If you’re planning to work with any contractors, you’ll need employers’ liability insurance the entire time they’re contracted by you.

Why? The clue’s in the word ‘contract’...it's a direct agreement where someone carries out a specific role, task, or piece of work for you. And where, in return, you look after them just as if they were one of your own employees.

In the same way you're responsible for providing them with all the tools they'd need to do their job, you're also responsible for the environment they work in and what happens to them while they're there.

But it also depends on the type of contractor you work with. Because, if you’re hiring in extra help through a temping agency or umbrella company, that organisation will often act as that person's legal employer.

So you should check your temp's employment status before you hire them. And ask whether their agency/umbrella company covers them under their own employers’ liability policy.

That should clear up the question of whether you'd need to carry EL for them or not...

What about sub-contractors?

Just like when you're working with contractors, what matters here isn’t your sub-contractor's employment or tax status but what they do for you. As well as how and where.

And, generally, there are two types of subcontractors:

- Labour-only subcontractors

- Bona-fide subcontractors.

Labour-only subcontractors tend to work under your direction and control and as part of your team. They’re often on your premises and free to use your equipment.

In contrast, bona-fide subcontractors will usually work off-site, using their own tools and equipment. They might have multiple clients. Because of that, they'll generally set their own hours and decide how and when they’ll carry out tasks for you.

However, while these definitions should mean you'd need EL for labour-only subcontractors and not for bon-fide ones, this doesn’t always work out in practice...and is why most brokers advise you carry employers’ liability insurance for any subcontractors you work with.

So I'd need employers’ liability insurance for contractors and subcontractors then?

In our view, that’s the best policy (excuse the pun).

Because even if you’re not responsible for your bona-fide subcontractor’s working environment when you first hire them, that doesn’t mean it'll stay that way. Or that someone won't accuse you of aggravating their long-term health condition after their contract’s over...

Whatever the situation, EL steps in if you’re ever in a position where you’d have to defend yourself from employee injury claims.

Because while EL looks after the people who work for you, it also protects you from the kinds of eye-watering compensation figures that could easily drag your business under...

In fact, that's why most employer's liability policy wordings use a very broad definition of what constitutes an ‘employee’. To cover as many people as possible.

Easy onboarding

Now you know employers’ liability insurance covers any types of contractors and subcontractors you work with, it’s worth paying attention to the details of their onboarding.

Making sure they're 100% comfortable with what they're doing and how, fulfils your legal obligations towards them. But it also reduces the chances they'll later file a claim against you.

Here's a few things to think about:

- Contracts – ideally, these will set out your legal and tax obligations and define any expectations you have. You might, for example, want to include things like the length of their contract, working hours, any rules for on-site/off-site working, payment terms, policies around data handling and confidentiality, etc.

- Training and equipment – does your contractor/sub-contractor have everything they need to do their job? Such as access to the right tools and systems, help with workstation set-up, IT support, etc.

- Health and safety briefings – e.g. the location of fire exits, what to do in an emergency, access to medical kits, personal protective equipment, appropriate risk assessments, etc.

- Record keeping – keeping track of who did what, how, and when means any potential claims can be investigated quickly and easily.

- Insurance – checking what insurance your contractor has or should have means everything’s in place from day one. For example, even if you have their EL covered, you might still want them to have public liability for accidental damage or injury. Or professional indemnity to cover them for negligence in their work.

Personnel helper

Ideally, taking on board a contractor makes light work of a tough job. Supporting you where it matters, for as long as you need them, as an easy alternative to hiring another employee.

Having employers’ liability insurance means they’re protected while carrying out that critical work for you. But there’s more to think about besides...

The UK government’s employers’ liability insurance guide explains about different types of workers and what your obligations are to them. While the HSE’s guide to employers’ liability insurance is essential for finding out about who needs employers’ liability insurance and why.

If you’d like more info and advice on employers’ liability insurance, you can also check out our at-a-glance guide to EL. Or give us a call on 0345 222 5391.

Image used under license from Shutterstock.

contractorsemployers liability insurancehealth and safetyrunning a businesssubcontractors