Doing international business is no longer a big deal. It's all part of our modern global economy. But it can have an impact on your professional indemnity (PI) insurance.

Or, more accurately, your professional indemnity insurance can have an impact on how you do international business. Or even if you should be doing it.

Do you need international professional indemnity insurance?

Most UK insurers' PI policies cover working abroad. But don't go grabbing your passport just yet. There are a few things to bear in mind.

Your insurance is subject to two different types of 'limits': geography and jurisdiction.

Geographical limits refer to where, physically, in the world you can work. Jurisdiction refers to the country's (or countries') law your contracts must be subject to/written in. You might see jurisdiction called 'applicable courts'.

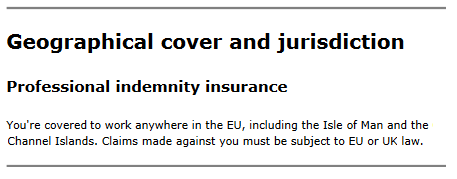

Your policy schedule will mention both geographical limits and jurisdiction, and will look something like this:

In this example, the PI policy's geographical and jurisdictional limits mean you can only work within the EU, and under EU law. There are variations of these limits and your schedule might specify any of the UK, EU, worldwide excluding USA and Canada, and worldwide - in any combination.

If you work outside the EU, you need to make sure it's specifically noted in your policy schedule. If it's not, you're not covered. And for obvious reasons, that can cause big problems.

Because unless you've made it clear you require international professional indemnity insurance with wider cover, it's likely your PI will only cover you for working in the EU. This largely depends on what you do and who you're insured with.

Working in the USA or Canada

If you work with US or Canadian clients, take note.

The jurisdiction of many 'worldwide' policies exclude USA and Canada as standard. That's because US or Canadian clients can be troublesome. This is for two reasons.

First, American companies like to sue first and ask questions later. It's no secret that America is far more litigious than here, and that makes insurers nervous. The greater the chance of a claim, the more they'll charge to cover it.

Second, US legal costs are considerably higher than pretty much anywhere else. Not only can a lawyer cost an arm and a leg, but a UK-based insurer appointing a US-based legal expert is a logistical, wallet-emptying nightmare. Again, that means they'll charge you more as a consequence.

So, if you land some work with an American or Canadian client, and the contract is written in their local law, you'll need a PI policy to match.

Or you can try asking for the contract to be changed to EU law, of course. It's worth looking into because changing your insurance can be pricey.

Peace of mind

Even if working outside the EU, or in the US or Canada, is a one-off, you still need to let your insurer know. They'll be able to update your cover, as well as tell you about any other requirements or legislation you need to know about.

For more information about international professional indemnity insurance, or to update your policy, get in touch with one of the team on 0345 222 5391.

Image used under license from Shutterstock .

insurance explainedmanaging riskrules and regulations