In this guide:

- What's a side hustle?

- Why start a side hustle?

- What type of side hustle should you do?

- How to plan ahead

- Tips for growing your side hustle

- The risks of running a side hustle

- How to pay tax

- HMRC's rules for online selling

- Getting the right insurance

The rise of the UK’s gig economy means more people are starting a side hustle. Over a third (39%) of Brits are now thought to have one, topping up their income by just under a grand (£914) a month on average.

And no wonder when the benefits are obvious: more money, more flexibility, more freedom to do things your way...

But, as with anything else, it shouldn’t be rushed into. Starting a side hustle takes time, commitment, and pre-planning.

To help you, we’ll take you through the basics of what’s involved – from simple steps to get you started, to your legal and tax obligations, and what insurance you might need.

What's a side hustle?

A side hustle (or side gig) is any activity where you make an income on top of your main job or occupation.

This makes side hustles different from a hobby (where you do something that interests you but don’t benefit financially from) or volunteering (offering up your time or services without a fee).

And while having one can lead to freelancing or running a small business, it doesn’t have to. How much time, money, and attention you devote to growing your side hustle is entirely up to you – and that's the beauty of it.

Being your own boss

Everyone’s motivations and goals are different. But the desire to supplement an income is why 61% of people start a side hustle in the first place.

If you’re naturally curious or entrepreneurial, a side hustle can be a fantastic opportunity. It’s a route to monetising an existing hobby, developing your skills, or challenging yourself in a new way.

Starting a side hustle could even widen your career perspectives and lead to you running your own business. Depending on your ambitions and how things go, you might end up reducing your hours at work or even leaving your day job.

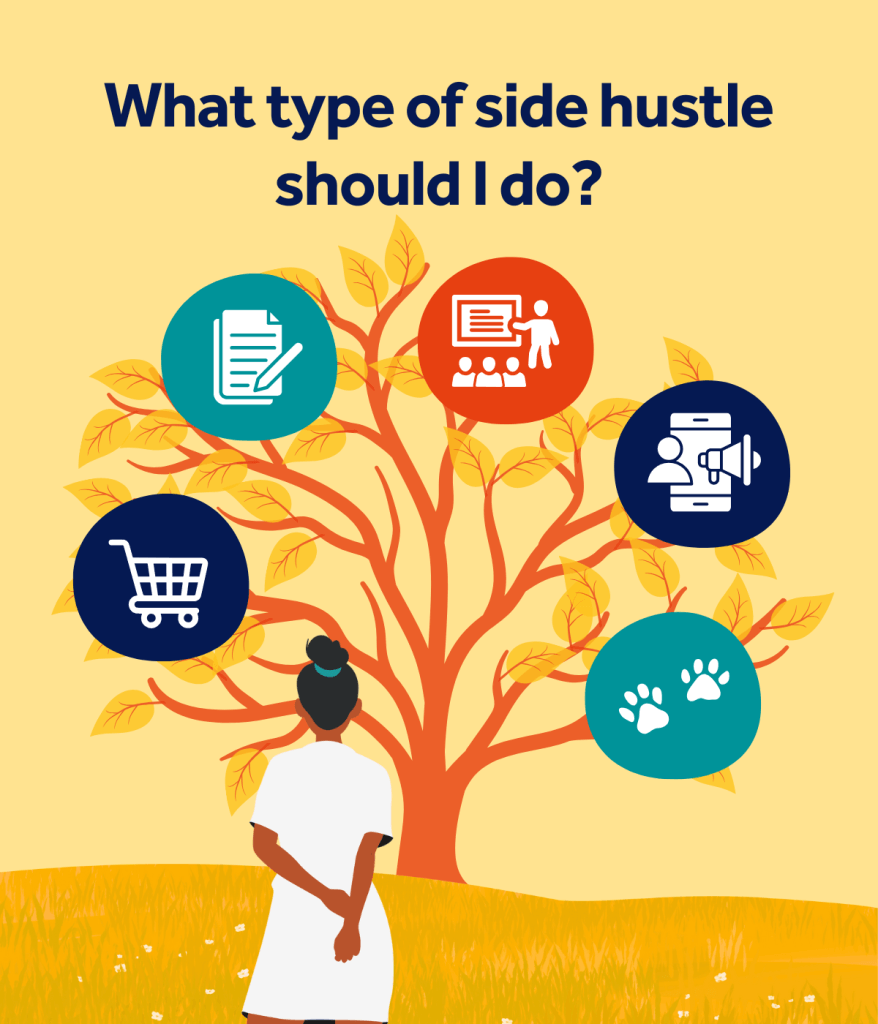

What type of side hustle should I do?

From selling online and tutoring, to delivery work and dog walking, there are lots of different types of side hustles, and lots of different ways to get started.

Love all things social media and fancy trying your hand at content creation? Maybe you’ve decided to pivot from your day job in IT to offer consultancy services to a few private clients? Or want to use your admin skills to set yourself up as a virtual assistant...

Plus, there are plenty of platforms that’ll allow you to quickly and easily sell goods or services – from online marketplaces like Etsy and eBay to pet sitting and house sitting apps.

Spoilt for choice? Before you choose which path to go down, it’s worth thinking about:

- Your skills and experience – what special knowledge, skills or training do you have? Is there anything you can do differently that might give you an edge over your competitors?

- Training and development – how much time, realistically, do you want to spend learning new skills and growing your side hustle?

- Time demands – what happens if you get an ad hoc request or need to do something urgently? Can you dedicate evenings or even weekends to your side hustle?

- Seasonality – Is your side hustle likely to be seasonal or a year-round thing? Will you be able to meet any sudden surges in demand?

- The bigger picture – Where do you see your side hustle going? Is it something you’d like to do casually and ad hoc, or are you ambitious about scaling it up?

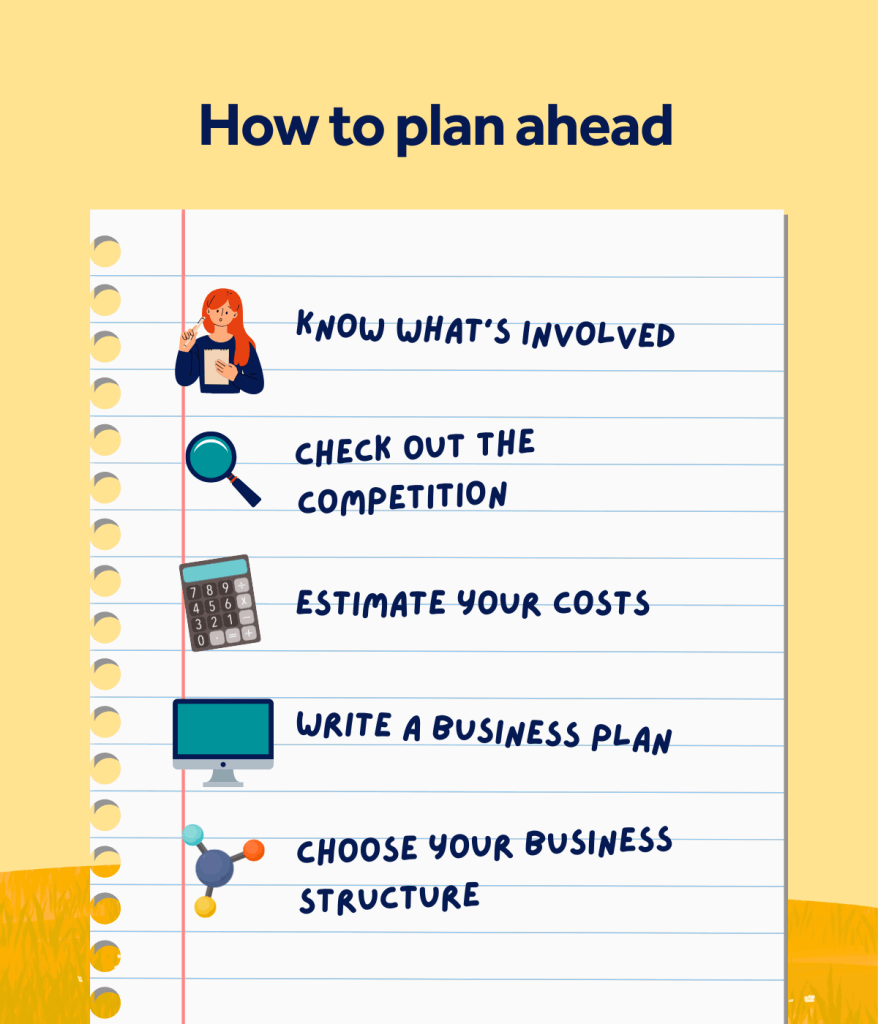

How to plan ahead

Ever heard the phrase, “Look before you leap”?

Once you’ve decided on your side hustle, it’s time to give yourself the best start possible and lay down some important groundwork:

- Know what’s involved – listening to podcasts and browsing business forums is a good way to pick up tips and get an idea of the highs and lows involved.

- Check out the competition – a quick google search should be enough to tell you what or who you’ll be up against. Is there a gap in the market you could fill?

- Estimate your costs – how much money will you need to invest in your side hustle? Can you work from home to minimise your overheads, or will you need to rent a space to work from? Are there any extra costs involved eg equipment, tools, stock, fuel, platform fees, insurance, etc.

- Write a business plan – think about practical steps, your goals and objectives, what support you’ll need, and how you want to grow. Putting everything down on paper can help you clarify your ideas and smooth out any bumps in the road.

- Sole trader or limited company? – whichever structure you choose will likely affect how you operate. Be sure to check out the government’s business set-up guide so you know your obligations are likely to be.

Top tips for growing your side hustle

Now you’ve got your side hustle off the ground, you’ll need to spend some time and energy pushing it forward. Here are some common-sense tips to help you stay proactive:

1. Market yourself

This is easier if you’re going down the digital platform route where you already have a captive audience. And slightly trickier if you have to be your own personal marketing guru...

Think about who your audience is, what their struggles and challenges are, what they expect from you, and how to reach them – whether through social media, online advertising or good old-fashioned leafleting and flyering.

Make sure you communicate what you offer clearly. And remember, the best way to promote yourself is to offer a consistently good service...you’ll be rewarded with repeat customers, positive reviews, and word-of-mouth recommendations.

2. Be time smart

Make the most of the time you have to work on your side business by factoring when you’re a) most productive, and b) have space to focus.

Doing too many things at once or leaving tasks until the last minute can lead to mistakes that cost you your reputation. So, unless there’s something urgent you need to deal with, it’s best to carve out time for your side hustle away from your other responsibilities.

Top tip: if staying on top of multiple to-do lists isn’t for you, task management platforms like Asana and Notion can allow you to set goals and organise your time more effectively.

3. Be flexible

If your side hustle ever leaves you feeling stretched or stagnant, think about switching it up a gear by expanding what you do. That could mean offering new products, services, starting a social media campaign or investing in some extra help or training.

Remember, you’re your own boss – and making mistakes is OK so long as you learn from them. Try something different and move on.

4. Invest in networking and partnerships

Working alone can feel lonely at times. Talking to other side hustlers via a business forum or at events can be a good way to brainstorm ideas, seek advice, form collaborations, or simply blow off some steam.

Is running a side hustle risky?

Running your own side hustle can be buzz when it’s going well. However, working on your own can also leave you stretched for time and struggling to deal with unexpected situations.

Here’s a heads-up on what to watch out for:

- Beware the burnout – juggling extra work on top of regular employment can be tricky –especially when you’re pressed for time or low on energy. Make sure to book in some time for other hobbies and self-care.

- Scams – unfortunately, fraudulent side hustle platforms exist in their droves. They may offer the promise of earning a quick buck but really, they’re just there to steal your personal info...as a rule, don’t trust any platform that demands up-front fees, check the terms of any contracts you’re offered, and do your research before you agree to part with your details.

- Conflict of interest – there needs to be a clear dividing line between your job and your side hustle. Working on one when you should be doing the other, using your employer’s ideas or spilling trade secrets can lead to things souring between you and your employer. And end with legal action.

- Breach of contract – it’s common courtesy to let your employer know if you’re earning extra income through a side hustle. However, it may be a contractual obligation too...check the terms of your employment contract before starting anything.

- Financial risks – if you’re bringing in an outside investor or arranging a loan to get your side hustle off the ground, you should be confident of getting a return on your investment. If you don't know, don't overpromise.

- Tax implications – you’ll likely have to pay tax on the money you make from your side hustle. And especially if your total income, including your main job, exceeds the basic personal allowance for all UK taxpayers (£12,570).

Understanding tax

HMRC uses various third-party data sources to identify where tax might not have been paid. So be warned: as your side hustle grows, you could end up thrust into the spotlight.

If you’re trading and making more than £1,000, you’ll need to register with HMRC as being self-employed. You’ll then have to file a Self Assessment tax return for that tax year.

HMRC classes your income as any money that’s paid to you, whether that’s cash in hand or through a bank transfer or digital platform. You should also keep track of any expenses that may be deducted from your tax bill.

Staying on top of your tax affairs is important. Failing to tell HMRC about your side hustle when you need to could result in an unexpected tax bill or penalties against you.

Our top tip is to use a spreadsheet or an accounting software programme like Xero or QuickBooks to ensure you always pay on time. Having a separate business bank account for your side hustle can also make it easier to calculate your income and expenses.

UK rules for online selling

Selling vintage or refurbished items online is the most popular type of side-hustle. With little more often needed to get started than a laptop or phone...

However, if you’re planning on selling goods or services through a digital platform, including any e-commerce websites, online marketplaces or apps, you should be aware of HMRC’s tax rules for online sellers.

As of January 2024, each platform you sign up will require certain information from you. Typically, your name, address, and National Insurance number (or company registration if you’re a business entity).

Provided you’ve meet certain criteria, they’ll then be legally obliged to report your details to HMRC:

- If you make more than 30 sales in a year, and/or

- you make over £1,700 for those sales.

Soon after, you should receive a statement from them that clearly shows your trading income (minus any fees, commission or deductible taxes).

After that, the usual tax rules for side-hustles will apply but only if your income is more than the £1,000 trading allowance.

Note that selling your own clothes or other items isn’t taxable if you’re selling them for less than you originally paid for (as you’re not making a profit).

Also, if you sell an item for more than £6,000, you may need to pay Capital Gains Tax on it.

To find out more, read HMRC’s guidance for selling goods or services in the UK.

Do you need insurance to run a side hustle?

Most likely, yes. For all the reasons we’ve already talked about under ‘risks’.

Running a business on the side doesn’t mean you’re any less likely to deal with potentially expensive or time-consuming problems. If anything, you may need a helping hand.

The legal and financial assistance provided by an insurance policy provides vital peace of mind. If there’s an accident or if something goes wrong and it leads to a claim against you, it’ll support you by covering your legal fees and compensation.

Take in these situations, for example:

- Public liability (PL) insurance – this covers you if a member of the public is injured or their property is damaged, and it’s deemed to be your fault. Think accidents like slips, trips, spills, or even resulting from the products you sell...

- Professional indemnity (PI) insurance – this is for if someone takes issue with the service you provide. It covers accusations of negligence, breaches of confidentiality, dishonesty, libel, slander, and more.

- Stock and contents insurance – pays to repair or replace broken, damaged or stolen items you use for your side-hustle. Especially as it’s unlikely your home insurance will cover your business stuff.

- Portable equipment insurance – covers any equipment you take out and about with you.

- Cyber insurance – helps you get back on your feet if a cyber-attack or data breach holds your data to ransom or means you’re unable to get online and work.

Help for side hustlers

We specialise in business insurance all kinds of self-employed people – from online retailers and tutors to virtual assistants and freelance consultants of all stripes.

To see if we can help you, try picking out your side hustle out from the list of occupations on our website. Or just pick up the phone to one of our friendly experts and ask. Our number is 0345 222 539.

Images created using assets from iStock.

business advicebusiness guidesfreelancersrules and regulationsrunning a business