Time to answer a very common question: should you get professional indemnity (PI) insurance or public liability (PL) insurance? Or do you need both?

Well, they're kind of similar in the way they both cover claims of negligence against you or your business.

But it’s the type of negligence that makes the difference. It dictates which of the two policies kicks in when there's a claim. Here’s what's what.

PI vs PL: key differences

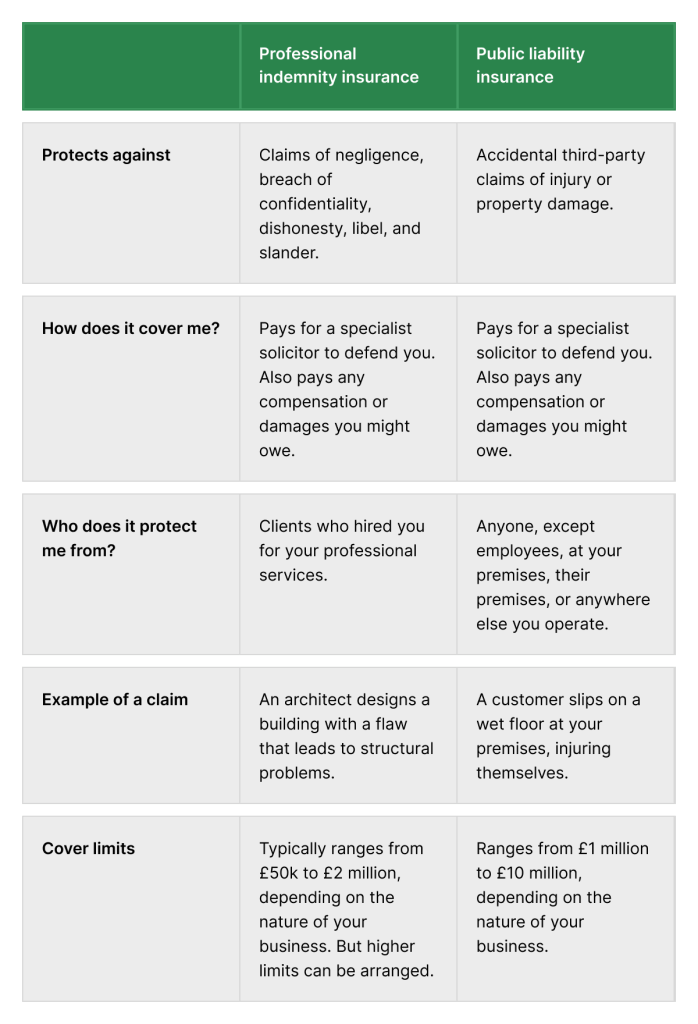

Before we dive into the nitty gritty, it’s important to get a basic understanding of the differences between professional indemnity and public liability insurance. Here’s a table that should act as a good starting point:

What professional indemnity (PI) insurance covers

Professional indemnity insurance protects you against claims made by clients unhappy with your work. It's essential for anyone providing a professional service such as giving advice, designing things, or completing specialist tasks.

If a client alleges you’ve made a mistake or been negligent, a professional indemnity policy covers the considerable legal costs of defending you – whether the claim is valid or not.

If you are in the wrong, your insurer also pays any damages, awards, rectification costs, or compensation you're liable for – up to your policy's level of cover.

As well as negligence, professional indemnity insurance can also cover claims concerning defamation, if you're accused of intellectual property and copyright infringement, and the dishonesty of your employees, partners, or directors.

What public liability (PL) insurance covers

Public liability insurance covers your business against third-party claims for injuries or property damage said to be your fault.

If visitors come to your work premises, or you go out and about and there’s an accident, you could be liable. Say someone trips over a cable in your office and falls, breaking a shoulder and smashing their expensive watch in the process.

Claims can be either for the cost of repairing or replacing damaged property or for compensating an injured person – or both.

Public liability insurance pays your legal costs as well as any damages, repair bills, or compensation you’re liable for.

Do I need both?

It depends on the nature of your business. You’ll need professional indemnity if clients hire you for your professional services. And public liability will be important if those clients visit your premises. Or you visit theirs.

A couple of simple examples might help. Let’s say you’re an accountant. You work with clients, but you only ever see them virtually. You’d need PI to cover any potential professional mistakes, but as you don’t visit clients and they don’t visit you, you probably wouldn’t need PL.

On the other hand, you might own a café. As you don’t provide any professional services, PI probably isn’t suitable for you. But you’d need PL because customers visit your premises every day.

Every business is unique. So, whether or not you need both PI and PL depends on what your business does and how.

Professional indemnity and public liability insurance cover limits

When you buy professional indemnity or public liability insurance, you’ll be faced with a choice of which cover limit you should choose. You can choose from a variety of different limits, but which one should you choose and why?

We’re going to sound bit like a broken record here, but it depends on the nature of your business.

Let’s start with PI. The cover limit you need will depend on a few things:

- Your business’s turnover

- The value of your largest contracts or the value of your largest job over the past three years

- Whether you're a member of a governing body or chartered institute

- The worst-case scenario of how much you’d be liable for if you made a mistake.

In particular, think about the value of your largest contract or job. How much could it reasonably cost you, including legal fees, if you made a mistake and were found to be at fault?

You should base your choice of cover limit on the worst-case scenario, so you can avoid being underinsured if you’re hit by a big claim.

If you’re a member of a governing body or chartered institute, you’ll have to get a minimum level of cover as part of your membership. Generally, the insurance requirements are easy to find on their respective websites.

Cover limits for PI generally range from £50k to £2m.

For PL, the question of cover limits is a bit simpler. Mainly because there aren’t as many choices. They generally range from £1m to £10m.

Choosing the right one for you will depend on a few things:

- Whether your business has more than one location

- Where your business is located

- The nature of your business

- Whether you operate outside of your usual premises, such as at events

- Whether you have any contractual obligations.

As with PI, consider the worst-case scenario that you might be faced with and plan accordingly.

Can I buy professional indemnity insurance and public liability insurance together?

It depends on what you mean by ‘together’. You can absolutely buy PI and PL are the same time, often with the same insurer.

But, they will be separate types of cover with their own wordings and cover limits.

It’s important when you do buy them at the same time to remember to carefully read both wordings before signing on the dotted line.

So, then...professional indemnity or public liability?

These two types of cover do two quite different jobs. And hopefully, you're now in a better position to decide whether it's professional indemnity or public liability insurance you need.

Or maybe both. Because that's what we recommend. It's particularly important if you’re a contractor or freelancer working with different clients on a regular basis.

That way, you’re covered for everything: the work you do, where you do it, and the people you do it with.

Feel free to call us on 0345 222 5391 if you have any questions.

Images ©PolicyBee 2025

insurance explainedprofessional indemnity insurancepublic liability insurancerunning a business